Simplifying and aligning a cross-channel customer experience delivery turns multi-vendor disconnects into valuable relationship-building opportunities.

Challenge: How to deliver a unified customer experience, when multiple partners affect the outcome

When an organization depends on partners to work directly with its customers along key points of the relationship lifecycle, delivering a consistently good customer experience is an even greater challenge.

In business for more than 55 years, this market-leading real estate developer has a laudable vision to create livable communities with sustainable buildings, public spaces, and neighborhoods where people have easy access to jobs, transportation, and local amenities. The company also owns and operates a diverse portfolio of residential and commercial properties.

Running this complex business involves a large network of partners: marketers, builders, designers and property managers, all of whom join experienced staff to deliver the customer experience under the developer’s brand.

This scenario makes delivering a consistent, low-friction, and sometimes even delightful customer experience difficult to quantify, control and track, and opens the door wide for disconnects that can harm customer loyalty.

Approach: Link customer experience and loyalty to prioritize, focus and plan for improved experiences

To anchor insights in data, the team gathered customer input across markets to identify pain points and illuminate disconnects between what the developer perceived and what their customers experienced.

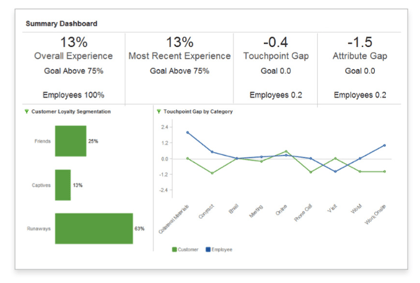

To gain a 360-degree view of the customer experience—and loyalty across channels, journeys and segments—we focused on the customer move-in and first year of ownership experience, a period of high touch, high anxiety, and (potentially) high reward. Our loyalty model segmented customers by their degree of emotional engagement with the organization based on the data. “Champions” were highly committed, “Friends” were reasonably satisfied, “Captives” reluctantly stay, and “Runaways” are on their way out the door.

In addition to better understanding the highs and lows of the partner experiences so important to the delivery of their service, this methodology revealed surprises in the direct customer-to-developer experience as well, and helped guide a clear roadmap for making measurable improvements.

Poor performance results provide a better learning opportunity than positive ones, especially for a successful organization with a long history and many partners.

Findings: Low loyalty and negative word-of-mouth revealed a disconnect between perception and reality

Some of the weaknesses research unearthed included:

Zero Champions

63% of customers were Runaways, meaning they’d sell (or rent) at the first chance;

Only 13% of homeowners rated their overall and most recent experience as “delightful”;

Just 38% of homeowners rated their interactions with the company and its partners highly. More damaging, 39% gave them the lowest ratings;

Purchase and move-in related touchpoints were rated as significantly under-performing;

Business-partner driven issues were negatively affecting customer satisfaction and loyalty;

Employees had an inaccurate and over-rated perception of the customer experience;

38% of surveyed homeowners gave negative word of mouth to others;

“Exceptional service” was the single greatest under-performer of the study.

Recommendations: Replace partner silos with a shared customer experience vision and newly collaborative, cross-channel organization

A customer-centric perspective of journeys, expectations, pain points, and perception drove a data-based view of performance gaps and opportunities. With objective metrics at hand, the client had the data to hold its leaders, partners and divisions accountable.

In immediate need of repair were caretaker issues around maintenance, security and responsiveness. Findings also revealed opportunities to better customize marketing by properties, customers and regions.

These initiatives fit into one new viewpoint: converge and integrate. Converge what had been viewed as disparate business lines, integrate information and processes, and provide a seamless customer experience that reflects the organization’s brand values—and consistently meets customer expectations.

Results: Learning from past mistakes re-centers and revitalizes this customer-focused company

Customer-centric insights helped this organization pinpoint where improvements were needed and where to take action in the future. By looking at performance gaps as opportunities for improvement, and positioning threats as a way to create new market differentiators, the client and their teams viewed the data with enthusiasm and productive energy.

By aligning employees and partners with a shared vision of customer experience excellence (and with clear markers by which to measure and monitor success), the company was able to focus on closing gaps across the journey by seamlessly serving—and at opportune moments delighting—customers at the touchpoints and across the channels that matter most. As a team, they now see that enabling a consistent experience that delivers at or above customer expectations is the greatest loyalty driver of all.

McorpCX is independently recognized as a top customer experience services and solutions company, enabling and guiding leading organizations since 2002.

Touchpoint Mapping®, Touchpoint Metrics® and Loyalty Mapping® are registered trademarks of McorpCX, LLC