Looking at customer experiences through customers’ eyes helped this regional bank design scalable, modernized, cross-channel experiences with its personal touch and local identity intact.

Challenge: Quantify and address the changing expectations of an evolving customer base

How does a bank adapt to growing competition and shifting customer expectations without losing what has always been its greatest strength and brand differentiator: an old-school, high-touch approach? That was the challenge facing this $1 billion regional bank with 17 locations in the South.

To adapt strategically, management needed a deeper, objective understanding of their customers’ evolving wants and needs. But they struggled to find a proven solution that would provide actionable, statistically valid data from all customer segments, employees and prospects.

Approach: Collect actionable customer insights with a focus on experiences and expectations

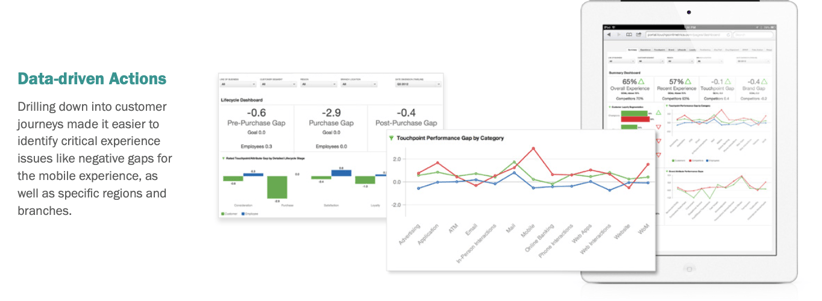

McorpCX first turned to the bank’s Voice-of-Customer (VoC) program, to gather the data and analytics that would serve as the foundation for actionable insights.

We tailored customer listening posts to gather trans- actional and relationship data on the touchpoints and brand attributes unique to the bank. The incoming data provided eye-opening customer insights, and snapshots of performance and perception across segments set the baseline for measuring customer experience improvements over time.

The outside-in customer insights that resulted delivered:

Detailed bank touchpoint and brand experience across the customer lifecycle;

Comparative analyses of the competition;

Individual branch performance data;

Perceptual alignment between employees and customers; and

Omni-channel customer data by a variety of demographics, including business segment, geography and products.

With this data, the team was able to analyze customer experience across multiple dimensions, which helped the bank scrutinize some long-held (and not always accurate) assumptions.

Quantitative insights made the road ahead much clearer for this bank. Changes are easy to monitor, and improvements to ROI have reinforced the bank’s confidence in the results.

Findings: For many transactions, high touch had become less desirable for busy clients

The results were clear. The bank’s tech-savvy customers valued speed and self-sufficiency as much as friendliness.

So the team dug into their data and potential offerings, and articulated a path to sustainable growth based on actual customer insights.

Mobile Experience: Customers wanted better mobile banking. Investment here would reduce high-cost branch banking and the competition’s big advantage.

Design Usability: In-place online banking services had subpar design and usability.

More Oversight: Empowering employees, part of the bank’s brand, led to inconsistent lending practices.

Wallet Allocation: The number of other financial institutions used by customers surprised the bank.

Awareness: Customers used national banks for services like wealth management, which this bank also provided.

Geographic Differences: The data showed different customer expectations by neighborhood.

Business Consulting: Despite a robust business-lending share, business consulting was in demand—and missing.

Transactional Inefficiency: Processes needed streamlining to speed transaction times.

Right Time for Face Time: Daily customers want fast, efficient service, but big financial decisions like mortgages take a face-to-face experience.

Recommendations: Use customer data to drive decisions, and save high-touch interactions for “moments of truth”

Despite overall positive customer perceptions, the bank used its findings to forge a path to sustainable growth. With customer experience to drive decisions and VoC to monitor results, they quickly started in on a series of improvements such as:

Upgrade mobile and web banking;

Redefine processes at all levels to streamline services, increase flexibility, and standardize practices;

Tailor experience to local needs;

Better promote high-value services (wealth management, business consulting etc.);

Continuously measure improvements against baseline data and validate changes by testing in multiple locations.

Results: A fresh start of actionable insights and a framework to rethink future strategies

By identifying experience and touchpoint gaps, the bank was handed a roadmap for scaling and delivering improved customer experience across customer segments.

Immediate improvements included shaving one- third off the time of some of their more demanding transactions. Mobile and web improvements moved high-cost, high-touch transactions to digital channels, without disappointing customer expectations.

The bank has also customized product offerings within different markets, boosting loyalty, advocacy and revenue. Most importantly, management now sees the direct correlation between customer experience and profit.

McorpCX is independently recognized as a top customer experience services and solutions company, enabling and guiding leading organizations since 2002.

Touchpoint Mapping®, Touchpoint Metrics® and Loyalty Mapping® are registered trademarks of McorpCX, LLC