A community bank’s customer experience and Touchpoint Mapping initiative replaced inaccurate assumptions with a clear view of wants, needs and opportunities.

Challenge: How to close performance gaps by replacing anecdotes with true customer experience metrics

Providing excellent customer experience is critical to maintaining customer loyalty and growth, especially for banks. However, like many companies, this community bank was relying on anecdotal information to evaluate customer experience.

Branch management used mystery shoppers and their own informal assessments, but they had no formal metrics or other means to quantify their customers’ experiences across channels.

The bank recognized that only by measuring experience could they accurately gauge and improve it. And they needed hard data to identify customer needs at the branch, product and people levels.

Approach: Gather quantitative customer experience and competitor data to uncover actionable insights

We built the bank’s Touchpoint Mapping dashboard around the brand, touchpoints, customer segments, and branch data unique to the bank, reflecting industry standards and attributes that make this institution special.

Within a few weeks, the bank was getting a clear picture of their customer experience, and the metrics highlighted both threats and opportunities.

Surveying customers on applicable attributes, relevant loyalty drivers, known competition, and real customer lifecycles, opens the door to rich information-gathering that easily surpasses ad hoc assessments.

As a result of these insights, management was able to:

Identify strengths and weaknesses relative to competitors (competitors’ customers were surveyed as well);

Monitor gaps in how customers perceived bank experiences vs. how employees felt they delivered them across all channels; and

Review profile data on individual customers who responded to surveys.

Particularly relevant for this bank was the ability to measure and compare individual branch experience.

Mapping the customer journey helped executive leadership align its perception of customer experience with reality. It also gave the marketing team two immediate goals: boost awareness and share-of-wallet.

Findings: Critical inconsistencies marred an otherwise excellent customer experience

Despite high marks on overall experience, the engagement revealed perception gaps and competitor vulnerabilities that needed immediate attention.

The bank had overestimated the customer experience at new branches by equating top-line revenue growth with a positive experience.

The bank’s perception of brand attributes like convenience and competitive rates and fees didn’t match those of customers.

Competitors held a major advantage in mobile banking capabilities, while the bank had overinvested in web experiences that weren’t important to customers (e.g., chat, calculators).

Employees and customers ranked the importance and effectiveness of static touchpoints such as radio and magazine ads very differently, revealing a misallocation of media spend.

Customers banked with 2.9 banks on average, giving this bank less than half their wallet share.

Only 20% of competitors’ customers were aware this bank existed. And research revealed a previously unknown credit union, that was in direct competition.

The bank’s awareness efforts under-performed across the board, with negative gaps around the website, online search functions, social media, and direct marketing touchpoints.

Recommendations: Leverage positive differentiators, improve key underperforming touchpoints, respond to competitive threats, and continue measuring

In the short term, this Touchpoint Mapping engagement articulated a clear-cut action list of key initiatives to close gaps, re-allocate budgets, and increase customer wallet share.

And with McorpCX’s guidance and process, the bank was able to see the benefits of a disciplined approach to information-gathering. For the long term, we recommended they continue to collect customer feedback, measure status, progress, and improvements over time, in order to align business strategy to segmented customer wants and needs, and make well-informed business decisions.

Results: The bank tossed out old assumptions and gained critical decision-making tools to meet actual customer needs

As a result of this engagement, the bank was able to connect the dots between actual customer experience, offerings, messaging, and process.

They re-allocated budgets and attention towards the experiences most important—and most disappointing— to customers, like mobile and online banking. With real intelligence on brand, perception and performance gaps, they were able to redesign failing processes and products to better meet customer expectations. And perhaps most important going forward, they experienced the benefits of a disciplined approach to managing their customer experience first-hand, and now have the training and tools to continue the work themselves.

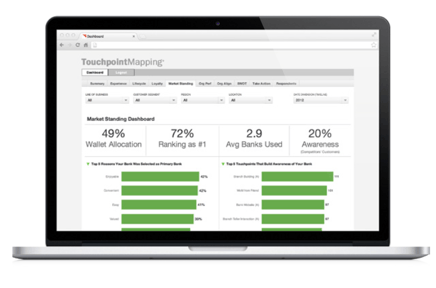

Market Standing Dashboard

This dashboard gave the bank an immediate view of its competitive position.

Laying out relevant data clearly helped the bank’s C-suite and CX team quickly see the gaps between expectations and how well the bank was actually performing.

McorpCX is independently recognized as a top customer experience services and solutions company, enabling and guiding leading organizations since 2002.

Touchpoint Mapping®, Touchpoint Metrics® and Loyalty Mapping® are registered trademarks of McorpCX, LLC