Redefining journeys and streamlining processes drives costs down, and customer and partner engagement up, for this global software leader.

Challenge: Provide a consistent and relevant customer experience across product lifecycles

This global software leader’s lack of insight around what motivated customer upgrades hampered its ability to plan, improve and anticipate customer actions and revenue drivers.

Internal research showed that customers received an inconsistent experience across product journeys, so the engagement focused on mapping, understanding and improving the upgrade lifecycle of these midmarket business customers, in order to turn around this negative renewal trend on high-margin revenues.

Approach: Understand the experience delivery process, and quantify customer motivations

Focusing on the greatest revenue opportunities, we mapped customer wants, needs, interactions and emotions through the re-purchase stages. Specifically, the McorpCX team examined the process at the stages of consideration, knowledge, (re)purchase, satisfaction and loyalty.

We conducted a series of internal interviews with a cross-section of management and channel-facing staff to understand internal perspectives, and to define the upgrade process and deployment support systems.

We then conducted qualitative, highly directional research through structured 1:1 interviews with partners (resellers) and end-user customers, measuring and analyzing customer perspectives and motivations.

Specific deliverables included:

A high-level lifecycle definition for mid-market customers;

A framework recommendation for measuring customer touchpoint management efforts;

Customer journey maps by persona-defined customer and partner segments;

Customer needs and levers to progression, by lifecycle stage;

Customer experience and touchpoint gaps and redundancies.

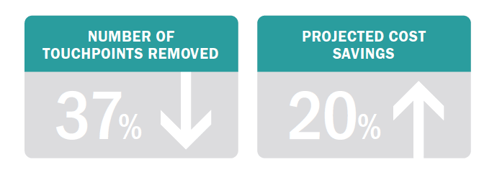

Customer experience and journey mapping led to a restructuring of the upgrade process, with a 37% reduction in total touchpoints and opportunities for cost reduction and process efficiency improvement of over 20% each.

Findings: Significant disconnects between internal, partner and customer perceptions

While it was critical to garner a better understanding of upgrade motivations, an unexpected—and illuminating— finding was that the company fundamentally misunderstood the process for upgrading software from the customer and partner perspective. While the prescribed upgrade process was highly detailed, it simply was not practiced or endorsed by the marketplace. Findings included:

Employees (all categories) and partners rated the defined upgrade process poorly;

Fundamentally flawed, the process for deploying upgrades was dictated by “others” in the corporation;

Reseller partners engaged in process work-arounds to satisfy both customers and management;

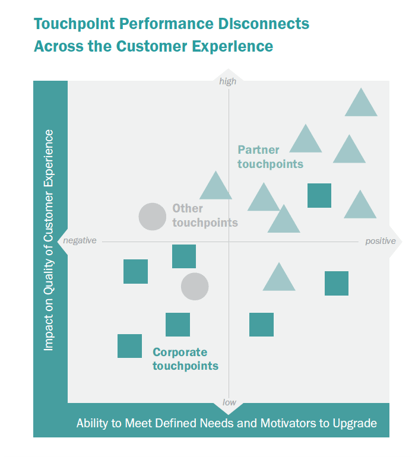

Corporate touchpoints were rated lowest performing by all audiences;

The lowest cost touchpoints had among the highest efficacy;

Highest value customers averaged 14 touchpoints, while some of the lowest value had more than 40.

In combination, these findings rendered a great number of the company controlled upgrade-related touchpoints (740 in total, across 17 different types) irrelevant and disposable.

Across 17 categories of “touchpoint types,” most corporate touchpoints had a negative impact on the quality of customer experience and were poor at meeting needs, while partner touchpoints tended to be better received and more effective.

Recommendations: Exceed expectations with an integrated upgrade strategy focused on high-value journey stages and interactions

Recommendations were filtered through the lens of touchpoint value, cost, and efficacy, as measured by their ability to move customers through the upgrade channel. This entailed greatly reducing the number of individual touchpoints, focusing on high-value touchpoints, and reorganizing the upgrade process.

McorpCX also made recommendations for ongoing measurement (and integration) of partner and customer feedback.

Results: Restructuring drives down costs, drives up sales, and boosts quality of reseller and customer experiences

By quantifying business value and focusing accordingly, we were able to guide this client to better define responsibilities and feedback loops. This led to implementation of an integrated strategy across customer touchpoints based on actual upgrade motivations and customerdefined processes. Among other wins was a 37% reduction in touchpoints and a 20% projected reduction in the ongoing cost of creating and managing touchpoints— all driving better experiences, stronger relationships and stronger sales.

McorpCX is independently recognized as a top customer experience services and solutions company, enabling and guiding leading organizations since 2002.

Touchpoint Mapping®, Touchpoint Metrics® and Loyalty Mapping® are registered trademarks of McorpCX, LLC