Focus on a better customer experience drives business process efficiencies, repurchase and retention, and boosts loyalty for this $30 billion commercial real estate lender.

Challenge: Six Sigma® process mapping didn’t get to the root of customer experience disconnects

With four divisions spanning three continents, this commercial lending division of a Six Sigma-driven Fortune 100 conglomerate was hampered by low customer satisfaction, retention and repurchase, as well as low employee loyalty. With $30 billion in assets, and processing more than $4 billion a year in new loans, repeat business made up just 28% of total volume, even though 80% of customers were high-volume brokers.

These issues led them to McorpCX, to help break down and better understand the issues, and map a path to improving their customer experiences, relationships and per-customer profitability. Even more important than making immediate course corrections, was developing a process and culture of viewing business processes from the customers’ points of view, and managing for long-term change.

Approach: Quantify the emotional side of customer experience to support Six-Sigma service quality

Significant voice-of-the customer and process mapping data existed, but company leaders surmised the organization didn’t have a solid understanding of which touchpoints were key to the sales process, and which were most important to delivering an optimal customer experience.

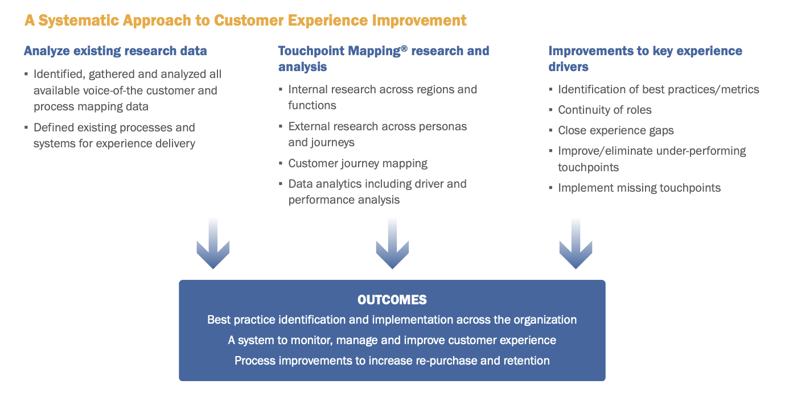

McorpCX began by identifying, gathering and analyzing all available voice-of-the customer and process mapping data. Then we defined existing processes for experience delivery, with the goal of understanding current systems, including team member roles and responsibilities for experience delivery.

By aligning an outside-in customer perspective with an inside-out business view, we identified key gaps in service delivery and specific opportunities to better align the people, processes, systems and technology that enable customer experience delivery. Cross-functional internal research and customer insights further informed a quantified view of the entire customer experience ecosystem.

We also identified loyalty drivers within each stage of the customer journey, providing the team with a 360 degree perspective on the entire customer experience. Analysis highlighted touchpoint paths, gaps and disconnects, redundancies and overall performance metrics, both positive and negative.

Integrating customer experience mapping and touchpoint monitoring into this company’s Six Sigma Quality programs drove significant process improvements, increases to retention and re-purchase activity.

Findings: Differing assumptions of an optimal customer experience

The organization did not understand wants and needs at different stages of the customer journey for either direct (owners) or indirect (broker) customers.

There was little knowledge around the customer journeys that actually existed, compounded by a lack of understanding of the value and efficacy of individual touchpoints.

There were significant gaps between internal and external perspectives of customer journeys, effectiveness and importance.

Most importantly, we found that the quality and consistency of the customer experience varied wildly from one office to another. Ironically, each region was leveraging Six Sigma Quality tools to deliver what they perceived as the optimal customer experience.

One example of a needless disconnect was the secondary market handoff. Customers felt abandoned when their only notice of a new note holder was a form letter and new payment schedule from the new company managing the loan. This seeming (and wholly unintentional) lack of care was a primary reason for customers not returning for new loans.

Recommendations: Identify and adopt best practices internally, and improve underperforming touchpoints

We focused our recommendations on defining roles and responsibilities of loan team members in support of the customer experience. We also defined CX best practices organization-wide, customized to their organization, business and culture, and implemented these through a series of “road show” presentations, customer journey mapping workshops, and train-the-trainer sessions. Processing and loan servicing changes focused on delivering a consistent experience that addressed specifically identified customer wants and needs.

Results: Dramatic increases in employee and customer satisfaction, and rising loan volume

As a result of our work together, major experience and process gaps were quickly addressed both internally

and externally. Teams initially trained by McorpCX monitored and improved customer experience efforts organization-wide, integrating customer journeys into Six Sigma Quality programs. In addition to driving early successes, efforts over time drove significant and systemic customer experience improvements, increasing employee and customer satisfaction and loyalty, retention and repurchase, and boosting overall loan volume.

McorpCX is independently recognized as a top customer experience services and solutions company, enabling and guiding leading organizations since 2002.

Touchpoint Mapping®, Touchpoint Metrics® and Loyalty Mapping® are registered trademarks of McorpCX, LLC